In this guide, we take a look at Medicare rate increases from 2020 to 2021 to shed some light on what we can expect for Medicare costs going forward.

CMS also announced that the annual deductible for Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from $198 in 2020. Medicare Part A Premiums/Deductibles Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. Deductibles Examples. Medicare Part A will have $1,484 deductible when you go to the hospital in 2021. This means that you have to pay the first $1,484 before Medicare Part A will step in and pay anything. Medicare Part B has an annual deductible of $203 in 2021.

We also outline some 2022 Medicare cost projections based on the annual Medicare Trustees Report.

2021 Medicare Part B Costs

Plan G High Deductible 2021

The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium.

While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

The table below shows the additional amount these beneficiaries will pay in 2021 — called the Income-Related Monthly Adjustment Amount, or IRMAA — based on their reported 2019 income.

| 2019 Individual tax return | 2019 Joint tax return | 2019 Married and separate tax return | 2021 Part B premium |

|---|---|---|---|

| $88,000 or less | $176,000 or less | $88,000 or less | $148.50 |

| More than $88,000 and up to $111,000 | More than $176,000 and up to $222,000 | N/A | $207.90 |

| More than $111,000 up to $138,000 | More than $222,000 up to $276,000 | N/A | $297.00 |

| More than $138,000 up to $165,000 | More than $276,000 up to $330,000 | N/A | $386.10 |

| More than $165,000 up to $500,000 | More than $330,000 up to $750,000 | More than $88,000 up to $412,000 | $475.20 |

| More than or equal to $500,000 | More than or equal to $750,000 | More than $412,000 | $504.90 |

Medigap plans can help cover your 2021 Medicare costs.

Compare plans

Compare plans2021 Medicare Part A Cost Increases

Most people receive premium-free Part A.

In 2021, people who are required to pay a Part A premium must pay either $259 per month or $471 per month, depending on how long they or their spouse worked and paid Medicare taxes.

Those are increases of $7 and $13 per month respectively from 2020 Part A premiums. The costs may increase again in 2022.

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible.

The Part A deductible amount may increase each year, and it will likely be higher in 2022.

2022 Medicare Part B Cost Projections

Based on reporting from the Centers for Medicare & Medicaid Services (CMS), the projected 2022 Medicare Part B premium is $157.70 per month.1

It's important to note that this figure only represents an estimate of 2022 Part B premiums. Actual 2022 premiums will be determined in the fall of 2021.

Will My Medicare Supplement Insurance Premiums Go Up?

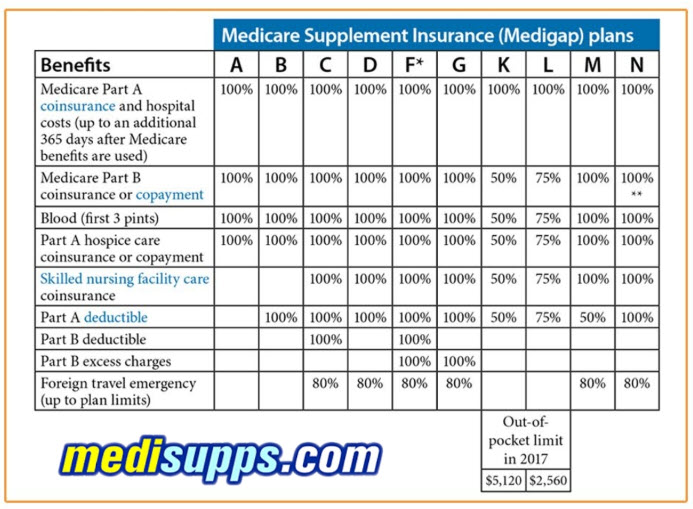

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments.

The average a Medigap plan premium in 2018 was $125.93 per month.2

This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above. Some 2021 Medigap plan premiums may also be higher.

Each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medigap premiums can increase over time due to inflation and other factors, so you can typically expect Medigap plan premiums to be higher in 2022 than they will be in 2021.

Compare 2021 Medicare Supplement Insurance Plan Costs

A licensed insurance agent can help you find Medigap plans that are available where you live. You can find out the types of benefits each available plan may offer, the insurance companies that sell them and the premium costs you can expect to pay.

You can request an online plan comparison for free, with no obligation to enroll.

Find Medigap plans in your area.

Compare plans

1 Medicare: Part B Premiums. (Updated May 6, 2020). EveryCRSReport.com. Retrieved from www.everycrsreport.com/reports/R40082.html.

2 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Is There A Yearly Deductible For Medicare

Resource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

© TheStreet Social Security and Medicare Changes in 2021From the pandemic to politics and the economy, it's been a wild year, especially for those near or in retirement. While some uncertainty remains in the outlook for 2021, here's what you need to know about Social Security, Medicare premiums and retirement plan contributions.

Popular Searches

Read about the valuable retirement plan and tax-related pandemic breaks set to run out at the end of 2020: Last Chance for 2020 CARES Act Retirement and Tax Benefits

Social Security

Nearly 70 million Americans will see a 1.3% increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2021, the Social Security Administration announced in October.

The 1.3% COLA will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2021. Increased payments to more than 8 million SSI beneficiaries will begin on Dec. 31, 2020. According to Andy Landis, author of Social Security: The Inside Story, the COLA is tied to the inflation rate -- specifically, the CPI-Urban, measured on Sept. 30 each year.

The estimated average monthly Social Security benefits payable in January 2021 will be $1,543 for all retired workers; $2,596 for an aged couple where both are receiving benefits; $3,001 for a widowed mother and two children; $1,453 for an aged widow(er); and $1,277 for all disabled workers. The maximum Social Security benefit for a worker retiring at full retirement age is $3,148 per month.

The Social Security Administration will mail COLA notices throughout the month of December to retirement, survivors, and disability beneficiaries, SSI recipients, and representative payees. But beneficiaries can also learn their new benefit amount by logging into their personal Social Security account.

Other noteworthy changes:

- The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $142,800 from $137,700.

- The earnings limit for workers who are younger than full retirement age (FRA) will increase to $18,960. (The Social Security Administration will deduct $1 from benefits for each $2 earned over $18,960.) The earnings limit for people reaching their 'full' retirement age in 2021 will increase to $50,520. (The Social Security Administration will deduct $1 from benefits for each $3 earned over $50,520 until the month the worker turns 'full' retirement age.)

- There is no limit on earnings for workers who are 'full' retirement age or older for the entire year. 'So if you reach FRA in 2021, consider starting your Social Security this year, even with substantial work,' says Landis. 'You can work all you want and get SS at the same time.' See, from the Social Security Administration, How Work Affects Your Benefits for details.

- The full retirement age for a person born in 1954 or earlier is 66. If you turn 62 in 2021, your full retirement age (FRA) is 66 and 10 months, said Landis, who noted that FRA is different for different birth years, and determines almost everything about your Social Security. Find your FRA at the SSA's retirement age calculator.

According to Landis, it's worth noting that you get a '100%' payment if you start at FRA but you get less if you start early or more if you delay until later. Starting at 62 in 2021 gets you a 70.83% payment for life. Every month you delay Social Security (up to age 70) gets you a higher monthly payment for life.

Note that if you're over 62 and haven't started payments yet, you still get the raise 'behind the scenes' in your future payments, says Landis, who notes you really get two raises behind the scenes as you delay payments: the monthly increase for delaying payments, plus the annual COLA.

When to file? The usual general rules apply, says Landis. 'Delay as long as you can, up to age 70, if you can afford to and if you expect at least average life expectancy,' he says. 'File earlier if you need the income, or expect a lower life expectancy.'

Medicare Benefits and Premiums

In November, the Centers for Medicare & Medicaid Services (CMS) announced the 2021 monthly Medicare Parts A and B premiums, deductibles, and coinsurance amounts.

The standard monthly premium for Medicare Part B enrollees will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020. 'The Medicare inflation adjustments were pretty reasonable this time thanks to Congressional action that limited the Part B premium increase to 25% of what it normally would have been,' said Elaine Floyd, director of retirement and life planning at Horsesmouth. 'Of course, we don't know what effect this will have on premiums next year. I guess we'll cross that bridge later.'

With the premium going up by just $3.90, Floyd says virtually no one needs to be 'held harmless' this year, even with a meager 1.3% Social Security COLA. The Medicare law contains a hold-harmless provision that limits the dollar increase in the premium to the dollar increase in an individual's Social Security benefit.

Also of note, about 7% of people with Medicare Part B are subject to the income-related monthly adjustment amount or IRMAA. The 2021 Part B total premiums for high-income beneficiaries can be found here.

For her part, Floyd recommends appealing your IRMAA if you are retiring. 'If your income will be dropping due to work stoppage, you do not need to pay the high premiums figured off your high earnings when you were working,' she says.

Other noteworthy changes:

- CMS also announced that the annual deductible for Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from $198 in 2020.

- The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,484 in 2021, an increase of $76 from $1,408 in 2020.

- In September, CMS announced that the average monthly plan premium among all Medicare Advantage enrollees in 2021, including those who pay no premium for their Medicare Advantage plan, is expected to decrease 11% from 2020 to $21 a month

Read Medicare Advantage 2021 Spotlight: First Look.

Retirement Plan Limits

As for retirement plans, the Internal Revenue Service announced in October the 2021 cost-of-living adjustments to the dollar limitations for qualified retirement plans and other benefits.

Most of the dollar limits, including the elective deferral contribution limit for 401(k), 403(b) and 457(b) plans and the dollar limit for catch-up contributions (if age 50 or older), remain unchanged from 2020 limits. For instance, the maximum annual elective deferrals for 401(k)/403(b)/457(b) plans is $19,500. And the age 50 catch-up limit is $6,500, the same as it was in 2020.

The maximum one can contribute to an IRA is $6,000 per year with an age 50 catch-up limit of $1,000. The contribution limit for Traditional and Roth IRAs remains the same in 2021 at $6,000. Employees age 50 or older are eligible to contribute an additional $1,000, for a total of $7,000.

Meanwhile, the inflation-adjusted amounts for health savings accounts (HSAs) and high-deductible health plans for 2021. The HSA limit for self-only/family coverage will increase to $3,600 and $7,200, respectively for 2021. The maximum annual out-of-pocket expense limits for high deductible health plans for both self-only and family coverage will increase in 2021 but the minimum annual deductible will remain unchanged from 2020 limits.

This article was originally published by TheStreet.